A New Chinese Giant Energy Company: The Merger between Shenhua and Guodian

At the end of August 2017, China’s government ended months of speculation by approving the merger between two large state-owned energy companies: the Shenhua Group and the China Guodian Corporation. Shenhua is a major coal-mining company that also owns power generation assets, whilst Guodian is one of the country’s ‘big five’ power generating companies. The value of the combined assets exceed US$ 250 billion (about RMB 1.8 trillion), making the new entity, to be known as the State Energy Investment Group, the largest utility in the world.

Shenhua is a vertically-integrated coal company. It produces close to 300 million tonnes of coal each year, and runs its own rail network and ports. In addition, it has power generating capacity of 83 GW, most of which is coal-fired. Shenhua is also China’s leading company in developing coal-to-liquids technology. In contrast, Guodian focuses on power generation, with an installed capacity of more than 145 GW. Of this, some 26 GW is wind power, giving Guodian the largest installed capacity of non-hydro renewable energy in China. The company’s annual coal production exceeds 50 million tonnes.

There are a number of business justifications for the merger:

- To help Guodian and Shenhua manage the risks relating to fluctuating commodity prices;

- To provide Guodian with cash from Shenhua to help pay off its debts;

- To give Guodian access to Shenhua’s coal supplies and transport infrastructure;

- To give Shenhua access to Guodian’s renewable energy portfolio.

The first of these arises from the fact that coal prices in China are subject to market pressures and rise and fall in line with international markets. At the same time, the government continues to regulate wholesale and retail electricity tariffs that prevents any direct link between the prices of coal and electricity. However, the reforms to the power sector announced in 2015 should start to address this particular problem, if fully implemented.

The wider, strategic objectives are two-fold. First, this is just the latest of a series of mergers between large, Chinese state-owned enterprises. Further mergers of power companies are also mooted. The Shenhua-Guodian merger makes it quite clear that the current leadership’s understanding of ‘reform’ as applied to the energy sector does not include promoting competition between companies within China. Rather, the aim is to increase their profitability at home and create giant, state-backed companies able to compete on the international stage. In other words, the merger is driven more by international industrial policy than by energy or competition policy. The challenge for the senior management of this new State Energy Investment Group will be to transform a potentially unwieldy behemoth into an efficient corporation. If the government pushes forward with further mergers of power generating companies, it will undermine the ongoing reforms to the power sector that are said to be directed at promoting competition.

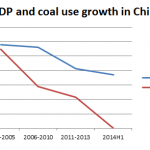

The second aim is to assist the government in its programme of closing down coal-fired generation capacity, cutting the production and consumption of coal, and reduce greenhouse gas emissions and air pollution. This task will be just as challenging. If the company is to close coal-fired plants and reduce coal production, both of which will result in job losses, it will need to persuade local governments not to block their plans. The last few years have seen some local authorities protecting coal-fired plants and obstructing the central government’s efforts to promote renewable energy. The reason being that the coal-fired plants generate more local employment and tax revenues than wind and solar energy farms. In undertaking the merger of Shenhua and Guodian, the government seems to have shifted the responsibility to the new company. Even within the company, the business logic will continue to support coal use, at least in the short-term, as the merger reduces the impact of fluctuating coal prices.